virginia estimated tax payments 2021 forms

Get Access to the Largest Online Library of Legal Forms for Any State. Please note a 35 fee may be assessed if your payment is declined by your financial institution as authorized by Code of Virginia.

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Did you owe Virginia state tax this year.

. A typed drawn or uploaded signature. TurboTax will automatically include four quarterly vouchers with your printout if you didnt withhold or pay enough tax this year. Enter your Virginia account number the ending month and year for the entire taxable year calendar fiscal or short taxable year for which the estimated payment is made not the ending date for the quarter the estimated payment is made.

At present Virginia TAX does not support International ACH Transactions IAT. Click IAT Notice to review the details. Determine your estimated tax using the instruction brochure Form IT-140ESI Write the amount of your payment on this form.

Virginia Estimated Income Tax Payment Vouchers and Instructions for. Ad The Leading Online Publisher of Virginia-specific Legal Documents. We will update this page with a new version of the form for 2023 as soon as it is made available by the Virginia government.

Click IAT Notice to review the details. If the ending month for the taxable year of the corporation is March 2021 enter 03 21. February 19 2021 622 PM.

760F 2021 Underpayment of Virginia Estimated Tax by Farmers Fishermen and Merchant Seamen Enclose this form with Form 760 763 760PY or 770 Calendar Year 2021 or taxable year beginning VA760F121888 2021 and ending First Name Middle Initial and Last Name of Both if Joint - OR. At present Virginia TAX does not support International ACH Transactions IAT. However you may pay more than the minimum if you wish.

We last updated Virginia Form 760ES-2019 in February 2021 from the Virginia Department of Taxation. Tax return you are required to make estimated tax payments using this form. Virginia estimated tax payments 2021 forms Sunday April 3 2022 Edit.

This includes estimated extension and. Download Or Email VA 760ES More Fillable Forms Register and Subscribe Now. They do this to head off a possible underpayment penalty on next years taxes.

Ad Access IRS Tax Forms. You can download or print current or past-year PDFs of Form 760ES directly from TaxFormFinder. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022.

Download This Form Print This Form More about the Virginia Form 760ES-2019 Individual Income Tax Estimated TY 2021 We last updated the 760ES - VA Estimated Income Tax Payment Vouchers and Instructions for Individuals in February 2021 so this is the latest version of Form 760ES-2019 fully updated for tax year 2021. 76 rows 2021. At present Virginia TAX does not support International ACH Transactions IAT.

TaxFormFinder provides printable PDF copies of 136 current Virginia income tax forms. You must pay at least the minimum amount calculated using the instructions to avoid being penalized. 760F Underpayment of Virginia Estimated Tax by 2021 Farmers Fishermen and Merchant Seamen Enclose this form with Form 760 763 760PY or 770 Calendar Year 2021 or taxable year beginning 2021 and ending First Name Middle Initial and Last Name of Both if Joint - OR - Name of Estate or Trust Your Social Security Number or FEIN.

Are often required to make estimated tax payments on a quarterly basis. More about the Virginia Form 760C Individual Income Tax Estimated TY 2021 If you failed to pay or underpaid your estimated taxes for the past tax year you must file form 760C to calculate any interest or penalties due with your income tax return. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number.

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. Complete Edit or Print Tax Forms Instantly. 2021 Form 770ES 2021 Form 770ES Virginia Estimated Income Tax Payment Vouchers for Estates Trusts and Unified Nonresidents 2020 Form 770ES 2020 Form 770ES Virginia Estimated Income Tax Payment Vouchers for Estates Trusts and Unified Nonresidents 2019 Form 770ES.

Download or print the 2021 Virginia Form 500ES 500ES - Forms and Instructions for Declaration of Estimated Income Tax for FREE from the Virginia Department of Taxation. This form is for income earned in tax year 2021 with tax returns due in April 2022. Ad Download Or Email VA 760ES More Fillable Forms Register and Subscribe Now.

At present Virginia TAX does not support International ACH Transactions IAT. Please enter your payment details below. Download past year versions of this tax form as PDFs here.

Click IAT Notice to review the details. Failure to make correct estimated payments can result in interest. You may get those vouchers if youre self-employed.

Please note a 35 fee may be assessed if your payment is declined by your financial institution as authorized by Code of Virginia. Effective for payments made on and after July 1 2021 individuals must submit all income tax payments electronically if any payment exceeds 2500 or the sum of all payments is expected to exceed 10000. Select the document you want to sign and click Upload.

Estimated tax payments must be sent to the Virginia Department of Revenue on a quarterly basis. Virginia has a state income tax that ranges between 2 and 575 which is administered by the Virginia Department of Taxation. Decide on what kind of eSignature to create.

Please enter your payment details below. Follow the step-by-step instructions below to eSign your 2021 form 770es virginia estimated income tax payment vouchers for estates trusts and unified nonresidents. We last updated the VA Estimated Income Tax Payment Vouchers and Instructions for Individuals in January 2022 so this is the latest version of Form 760ES fully updated for tax year 2021.

There are three variants.

Form 1116 Step By Step Guide To Claim The Foreign Tax Credit

Prepare And Efile Your 2021 2022 Virginia Income Tax Return

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement Definition

Customizing Invoices Within Quickbooks Online

Quarterly Tax Payments How To Pay Estimated Tax Payments

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

News Updates From November 2 Dow Jones Closes Above 36 000 Cdc Backs Covid Vaccine For Young Children Us Sues To Block Publisher Mega Merger Financial Times

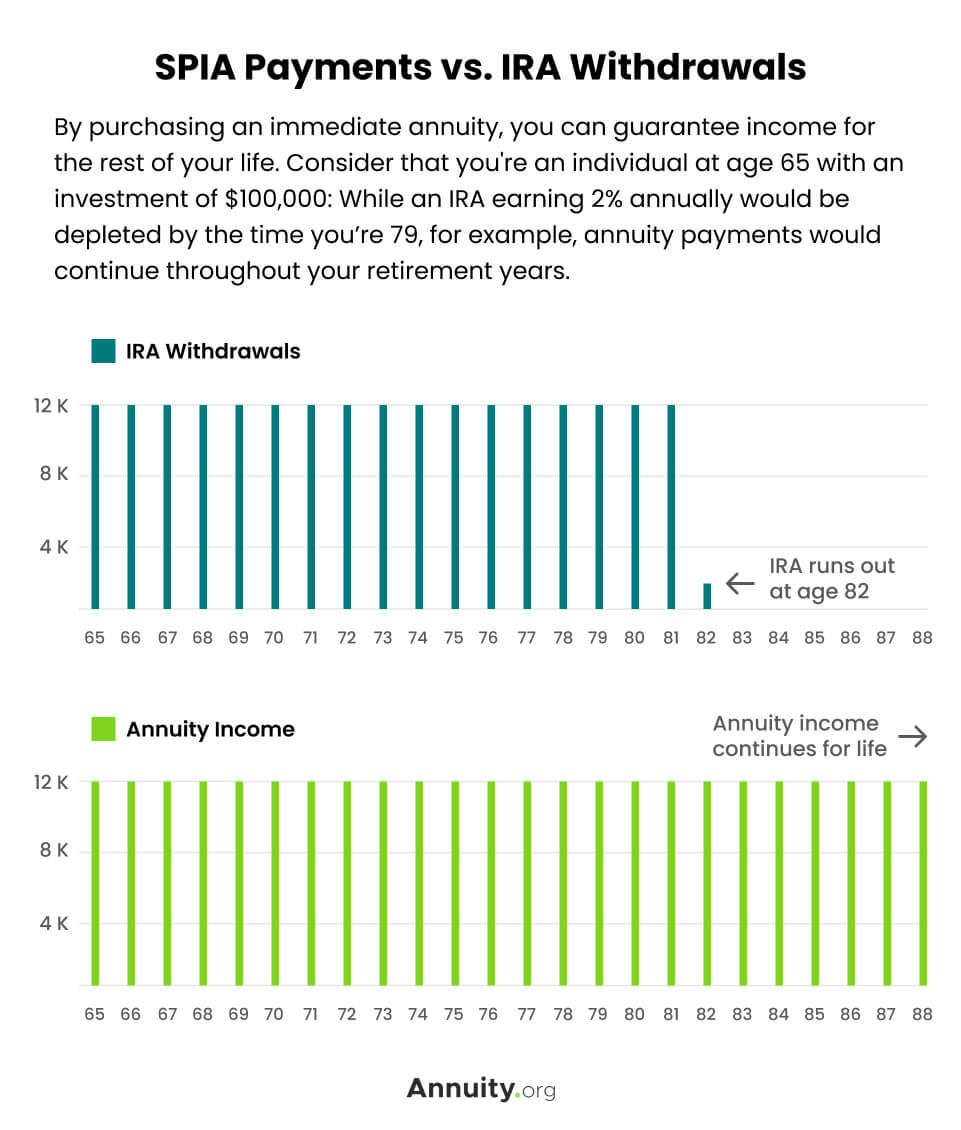

Single Premium Immediate Annuity Spia Rates Pros Cons

Harwood Associates Accounting And Tax Service Inc Home Facebook

Customizing Invoices Within Quickbooks Online

/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-01-5994210f98a84b468a9a113c94643d50.jpg)

How Are Prepaid Expenses Recorded On The Income Statement

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement Definition

Form 1099 Nec For Nonemployee Compensation H R Block

:max_bytes(150000):strip_icc()/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

2021 Salary Guide Pay Forecasts For Marketing Advertising And Pr Positions